Have you ever heard those horror stories where an employee embezzled the company of millions of dollars? I always was wondering how this type of business fraud could happen. Were they that good that they could deceive everyone? How much trust did they build before stepping over the line? The truth is no matter how fraud happened, it can be prevented.

Today, I want to talk about a specific type of fraud, and that is occupational fraud. In other words, how employees or partners are stealing money from the business.

Let’s bring in some numbers first.

- 37.7% of small business experienced frauds in the period from 2002 to 2016 (that more than 1 in 3 businesses!)

- 87% of fraudsters were first-time offenders with clean criminal record history

- 77% of frauds are committed by someone from accounting, finance, customer service or executive management

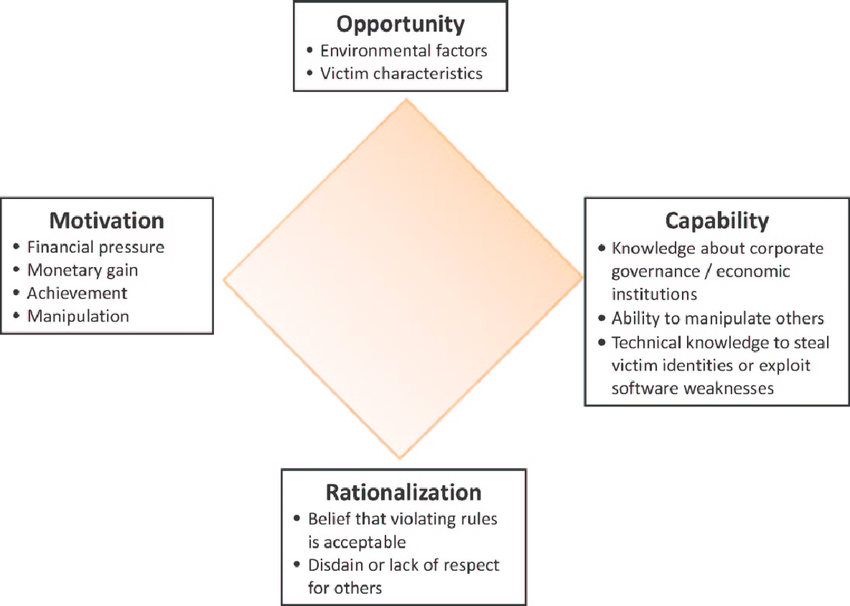

In order to understand how to prevent fraud, we need to analyze the four dimensions that make fraud possible. The theory behind it was named with a catchy name by researchers.

Fraud Diamond

The diamond (no irony intended here) has four key criteria that practically enable fraud to happen in any business:

- Opportunity: what allowed the fraud to happen? Did the person has unrestricted access? Was there a significant lack of controls?

- Motivation: what motivated the person to commit fraud? Was the person in debt? Did they have peer pressure to conform?

- Capability: was the person knowledgeable about company’s policies (or lack thereof)? Was the person technically capable to commit fraud?

- Rationalization: what is the work environment like? Is it toxic? Did the person tend to blame outside factors?

So now that we are aware how fraud happens in organizations, let’s learn about the simple but proven ways to prevent it. Here are the five ways to ensure that fraud is prevented in your small business.

Do Thorough Background Checks

You can’t do too much homework when you are bringing a new employee into the company. If they will be dealing with sensitive information like finance, accounting or banking data, make sure you order a criminal background check on them.

Check their educational information. If they’ve recently graduated, ask them to order the official sealed transcripts from the university to be sent to your name. Call their professional organizations to confirm they designations.

When doing reference checks, make sure you speak with their direct supervisors at their previous job (personal and colleague references should be a red flag). Ask extremely detailed questions and drill down to see if they actually worked at that place. Ask why they left and if there were any issues with employee performance.

Ask what specific duties was the person performing. Have a resume in front of you and see if the person on the other side of the line is reading to you answers from the candidate’s resume.

Segregate Accounting and Treasury

In simple words, make sure that the person who is entering the accounting information is not able to access the bank accounts. A simple monthly bank reconciliation will uncover any discrepancies between the bank and the accounting system.

Ideally, you want to be in charge of your payments and bank transactions where someone from outside (e.g. an accounting firm) is performing the accounting and reconciliation function.

Also, restrict access to check printing and check paper. Especially, if it is a pre-printed check printing paper that shows banking information.

If you have someone in your company doing accounting for you, make sure they don’t have access to your bank accounts. That is a recipe for fraud and may result in loss of signficant amounts of funds.

Review and Approve All Payments Daily

One of the most common frauds that takes place in smaller organizations is when an employee sets up a fictitious vendor company. After that, s/he sets up a bank account under this vendor name. What is left is a periodic payment of fraudulent invoices to that vendor.

Create a process where there must be someone approving all external outgoing transactions in your company. It can be a controller, an external accountant or yourself. This way you (and everyone else in the company) will know that outgoing transactions are reviewed and approved by a separate authority.

Introduce tight controls for vendor setups. All vendor setups must be approved by an authorized person in the company. Again, ideally, separate from the accounting records.

Setup Automatic Limits on All Outgoing Transactions

For example, make sure that all wires and direct debits over $500 require a 2nd approval from the owner of the company. Or put limits on company credit cards (monthly limits, single-purchase limits etc.).

All exceptions should be properly explained to the controller or the business owner. At the very minimum, request your financial institution to send you an automated text message with details of electronic transactions if they exceed any of these limits.

Setup an Anonymous Hotline

In most cases, frauds are committed by several individuals who are colluding for the same purpose. Studies, however, show that 42% of frauds (almost half) were uncovered by someone calling an anonymous hotline and reporting the fraud.

You may not have a separate line, but you can hire a company for that purpose. The line can be used for any other potential issues that can arise in the company (ethics, sexual harassment, inventory stealing etc.).

The simple fact that you let everyone in your company know that this line exists for these purposes will deter 9 out 10 fraudsters.

As you can see, there are several ways to prevent employees from stealing your hard-earned money from your company. In addition, make sure you follow common sense approach. In my mind, the best controls are when the opportunity is eliminated. Also, ‘Trust, but Verify’ should be your motto when dealing with your finances at any level.

Finally, ask your accountant how you can design your systems to prevent fraud in your business. A good accountant should be able to provide a competent advice on this matter.