Introduction

We frequently receive requests to assist with filling out the form W-8BEN-E from Canadian eCommerce sellers. Sellers who sell on Amazon, Shopify, eBay, WooCommerce, and other eCommerce platforms are often required to present this form to identify themselves as a foreign company in the U.S.

In the past, we used to charge $150 CAD for our work to prepare this form. Now that we are moving toward CFO-level services for eCommerce companies, we decided to spread the word and share some of that internal knowledge with the masses.

We also provide a sample W-8BEN-E form pre-filled with some of the information at the end of the article. You can download, plug your company information where appropriate, print, sign, and use it for your business purposes.

If you are pressed for time, you can jump to this section of the article to download it. You can also read more information about the form in the following sections to understand your obligations and requirements better.

We hope that Canadian online sellers will find this knowledge useful.

Disclaimer: we have to state this for legal purposes. Please don’t treat this general information as professional advice pertaining to your situation. This is information for educational purposes only. Your tax circumstances may be different. Speak to a tax professional of your choice before making any decisions. Otherwise, apply it at your own risk.

Now that we got this legality out of the way, let’s dive into the meats and potatoes of form W-8BEN-E for your eCommerce business.

General questions about form W-8BEN-E

What is the purpose of the form?

If you do business or earn any kind of income in the U.S. as a foreign entity, you are required to identify yourself as such.

The U.S. tax law states that certain payments, including payments for goods and services, made by U.S. companies to their foreign business partners are subject to 30% withholding tax.

To enforce the law, U.S. companies are essentially obligated to turn into withholding agents and are required to withhold that tax percentage from payments made to foreign companies.

Form W-8BEN-E helps reduce that withholding tax rate from 30% to 0% based on the provision in the U.S-Canada Tax Treaty.

U.S. vendors will collect and keep the form on file. In the case of an audit, the Internal Revenue Service (IRS) will require the vendor to present that form as a document that will verify the tax status of the company that received the payment.

Form W-8BEN-E also exempts vendors from reporting 1099 to the IRS. Form 1099 reports all payments made to other entities so that IRS can identify businesses that don’t file their taxes properly.

Who is required to fill out and present the form?

Based on the U.S. tax law, any U.S. company making payments to non-U.S entities is required to obtain this form. If a vendor, supplier, or business partner does not request the form, you may choose to present it when you will be initiating the business relationship with that vendor. It will help you avoid potential delays in receiving your payment and possible issues with the IRS.

Where can I get the latest W-8BEN-E form?

The most recent version of the form can be obtained from this IRS page.

What is the difference between forms W-8BEN and W-8BEN-E?

The former is required to be filled out and presented by individuals and sole proprietorships. The latter is required to be presented by corporations.

What version of the form should I use?

You should fill out the latest version of the form, which is dated as 2017 at the time of writing of this article (April 2019). We don’t guarantee that this article applies to any future form revisions by the IRS. So, please exercise due diligence and make sure that you are filling out the most recent version of the form.

Why is the form so long?

There has been a major revision to the form in 2017 in an attempt to document any offshore activities by U.S. companies. Your company will need to fill out only specific parts that pertain to your operations.

Tax-related Information for eCommerce Sellers

Should I send the completed form to the IRS?

No. This form is usually required by your U.S. business partners to be kept on file in case of an audit.

Does the form W-8BEN-E obligate my eCommerce company to file U.S. tax returns?

No. In the case of eCommerce sellers, it simply identifies you as a foreign entity claiming tax treaty benefits to reduce your withholding tax rate.

Do I need to have an EIN to fill out the form W-8BEN-E?

No, you are not required to have an employer identification number (EIN). But you are required to provide a foreign tax identification number (TIN) in the field 9b instead. For Canadian companies, the foreign tax identification number would be their 9-digit business number that was issued by the Canada Revenue Agency (CRA).

What specific article in the U.S.-Canada Tax Treaty reduces the withholding for Canadian sellers to 0%?

You will be relying on Article VII of the Treaty. This article effectively protects Canadian companies from U.S. withholding taxes on business profits if they don’t have a permanent establishment in the U.S. (branch, office, employees, etc.). The article of the Treaty says:

“The business profits of a resident of a Contracting State shall be taxable only in that State unless the resident carries on business in the other Contracting State through a permanent establishment situated therein. If the resident carries on, or has carried on, business as aforesaid, the business profits of the resident may be taxed in the other State but only so much of them as is attributable to that permanent establishment.”

What is the concept of limitation of benefits (LOB)?

The concept of limitation of benefits prevents Canadian companies controlled by non-residents from claiming benefits under the U.S.-Canada Tax Treaty. Its purpose is to avoid non-eligible companies doing treaty-shopping to minimize their tax liabilities.

If your company is engaged in active trade or business AND is controlled by a Canadian natural person, then your company will pass the limitation of benefits test.

What if I earn Effectively Connected Income in the U.S.?

If you earn effectively connected income (ECI) in the U.S. you are obligated to fill out form W-8ECI.

ECI means that you are regularly and continuously relying on elements of U.S. infrastructure to source U.S. income (warehouses, agents, 3rd Party Logistics, Amazon FBA, etc.). You can read more on the topic of ECI in this section of the article for Amazon sellers.

If you earn ECI in the U.S., you are also obligated to register for an employer identification number (EIN) and file U.S. tax returns for your entity.

What if I had a change in circumstances?

If any of your company details have changed (address, name, business number, etc.) you are required to prepare a new form.

How long is the form W-8BEN-E valid?

It is valid for a period starting on the date the form is signed and ending on the last day of the third succeeding calendar year (e.g. you signed the form on Jul 15, 2019, the form will be valid until Dec 31, 2022).

You will have to fill out the most recent version of the form after the expiration date.

Where can I learn more about my tax obligations as an eCommerce seller?

We recommend you read our other blog articles on the topic of eCommerce taxation:

- eCommerce Tax Guide for Canadian Sellers

- Amazon Tax Guide for Canadian Sellers in the United States & Canada

- Selling Online in Canada – Tax Obligations You Need to Know

Vendor-specific information for form W-8BEN-E

Does Amazon require this form?

Amazon does not specifically require this form to be submitted to them, but when you provide details during the registration process in the tax section part of the application, they walk you through the steps that identify you as a foreign company.

Effectively, they are asking you for all the relevant details required by U.S. tax law as part of the registration.

Does PayPal require this form?

Yes. As far as we know, if you open a PayPal account in the U.S. as a foreign company, they will require you to submit form W-8BEN-E as part of the application process.

What about other payment & platforms service providers?

Most companies will explicitly ask you to identify yourself as a foreign company or request that form. If they don’t ask for your U.S. tax status documents, then we would recommend that you inquire about it.

We have seen cases where U.S. vendors would submit full payment information on form 1099 to the IRS for foreign companies. We can assure you that these kinds of mistakes will take a considerable time & effort to resolve with the IRS given the size of their bureaucratic machine.

Filling out the form W-8BEN-E for eCommerce Sellers

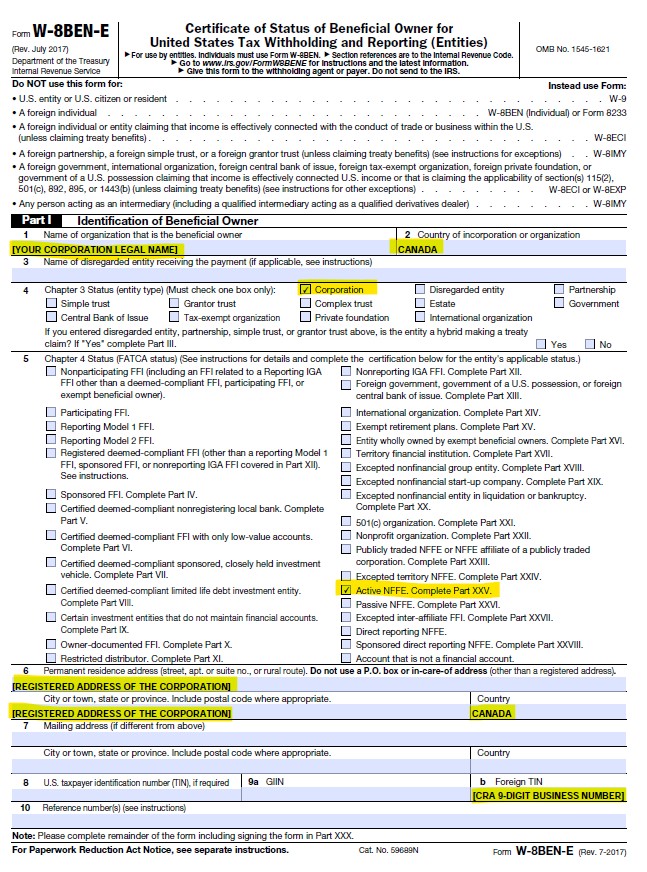

Part I – these are the required fields that need to be filled out:

1. Provide your legal company name

2. Country of incorporation should be Canada (or other country of incorporation)

4. Select box ‘Corporation‘

5. Select box ‘Active NFFE‘

6. Add your registered company address

7. Include your mailing address, if different

8. If you have an EIN, insert it in this field,

9b. Add your CRA business number

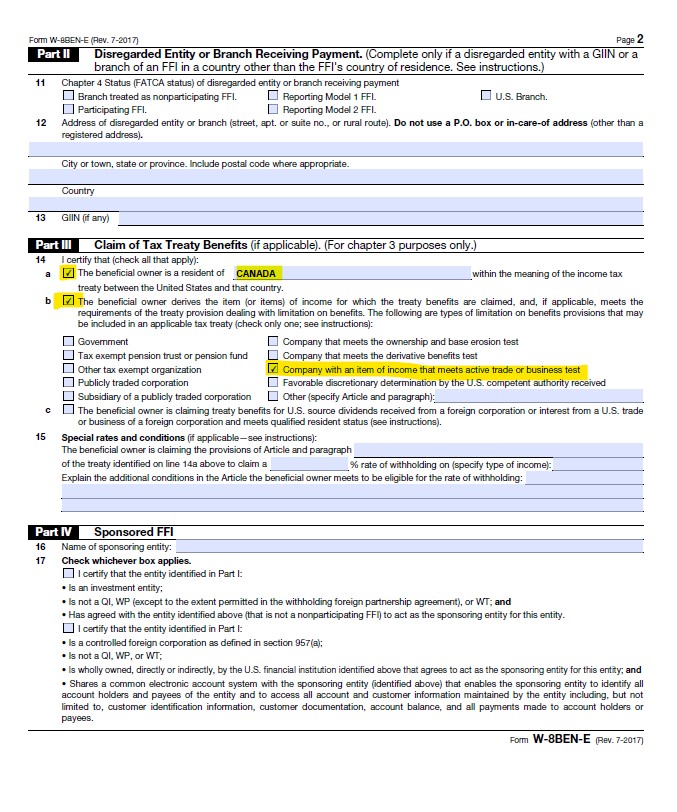

Part III – these are the required fields that need to be filled out:

14a. Insert ‘Canada’ in the field

14b. Select ‘Company with item of income that meets active trade or business test‘

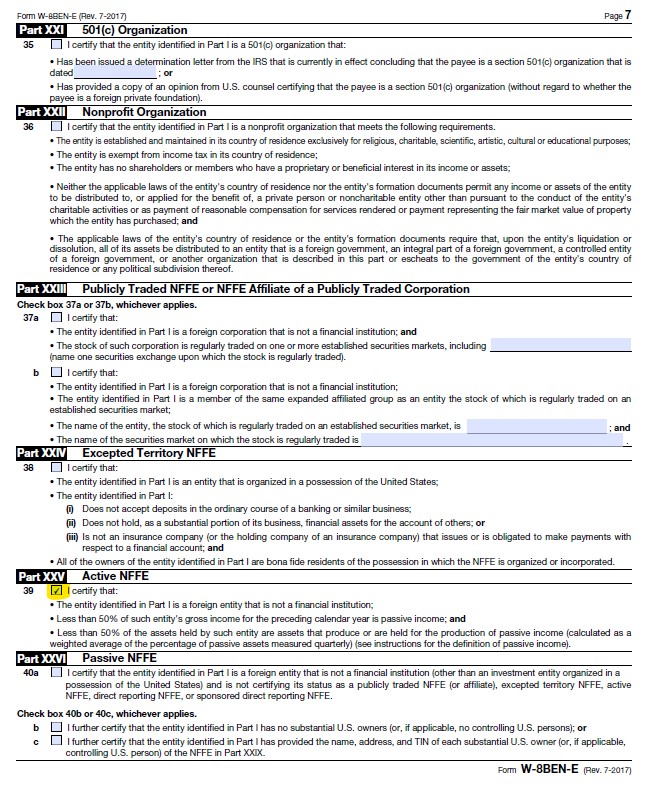

Scroll all the way down to Part XXV and select the box 39

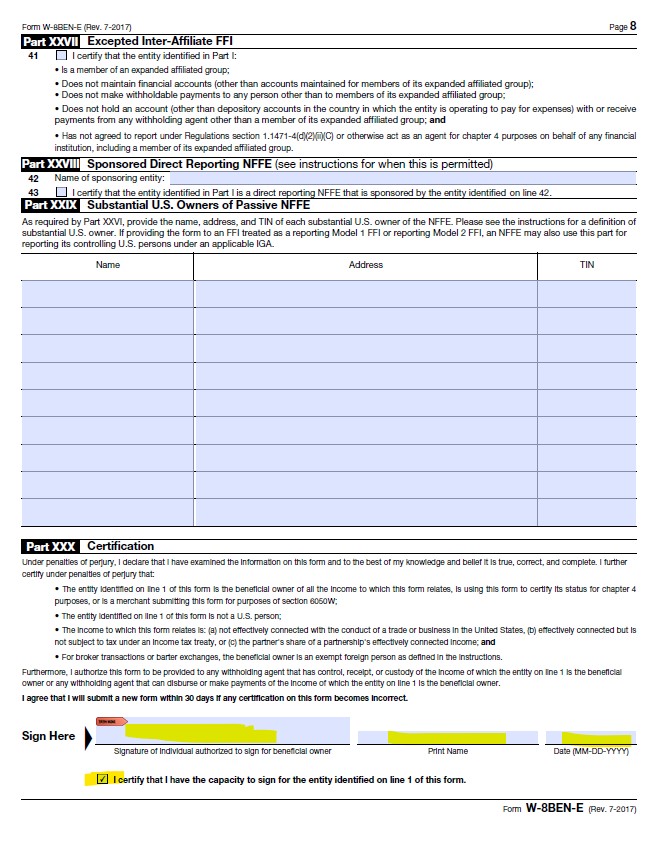

Type in your name and date.

Put a check mark to the certification box.

Print out the last page, sign it, scan it, and insert it back into the document. Your form W-8BEN-E is now complete.

Sample W-8BEN-E form for eCommerce Sellers

Above is the link to the pre-filled 2017 version of the form (the latest version as of the date of writing this article in April 2019). The form is a fillable PDF that you can download, make changes to, and use for your purposes.

As mentioned previously, please use it at your own risk with caution and professional advice.

Best of luck!

References

https://www.irs.gov/instructions/iw8bene

https://www.irs.gov/forms-pubs/about-form-w-8-eci

https://www.paypal.com/us/smarthelp/article/how-do-i-provide-paypal-with-fatca-information-faq3494

Hi Boris,

Thanks for the valuable information and i have a quick question.

Once we provide W-8BEN form to the US entity and we receive money then do i need to pay tax for that income in Canada…. pls advise