We are frequently asked about the best business structure for e-commerce sellers. We are happy to answer this and other related question in this article.

What are the common types of business structures available to Amazon, Shopify, or e-commerce sellers?

There are three (3) main types of business structures available to e-commerce sellers in Canada:

Sole Proprietorship

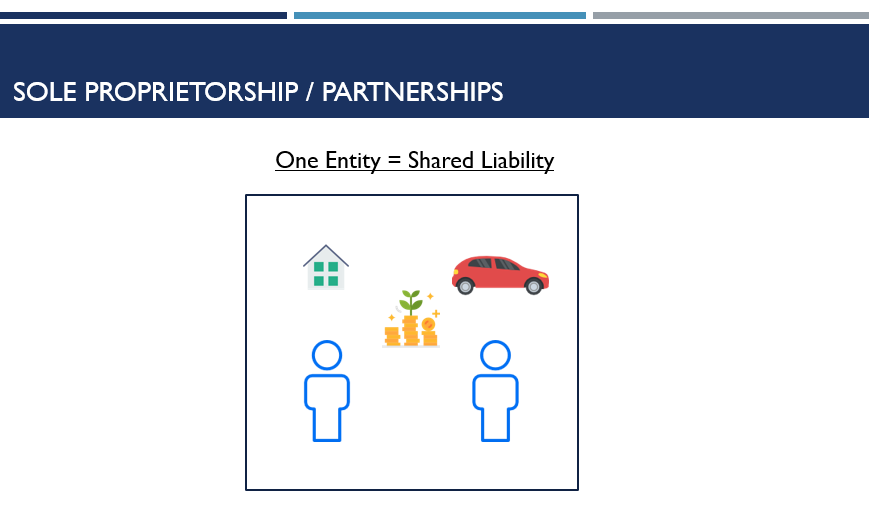

With the sole proprietorship business structure, you and your business are not separable. Business assets are your assets and business losses are your losses. This simplifies accounting and tax filing for a business and will result in lower accounting bills.

However, this business structure does not allow for long-term tax planning and does not protect your personal assets from business-related liabilities.

This is the simplest business structure. You can start operating your business as a sole proprietorship under your personal name without any additional registrations or business licenses.

You can operate your sole proprietorship under a business name as well. For that, you will need to register your business name with your provincial business authorities and obtain a business license.

Partnership

Similar to sole proprietorship, a partnership is also a flow-through entity. It does not get taxed separately and all net profits are distributed to partners according to their ownership percentage.

Partnerships have a lower compliance cost compared to corporations. There may be multiple partners involved in the business and the cost of tax work can be significantly less compared to that of a corporation.

There are general and limited partnerships that you can operate. If you operate a general partnership, all members will be equally liable for damages and losses of the partnership with unlimited liability. In a limited partnership, non-active partners are only liable for damages up to their investment amount into the venture (hence the name “limited partnership”).

As you can see, partnerships simplify the compliance process but result in unlimited liability for general partners. In addition, a partnership agreement is strongly recommended to avoid disputes and major disagreements between partners in the future.

Corporation

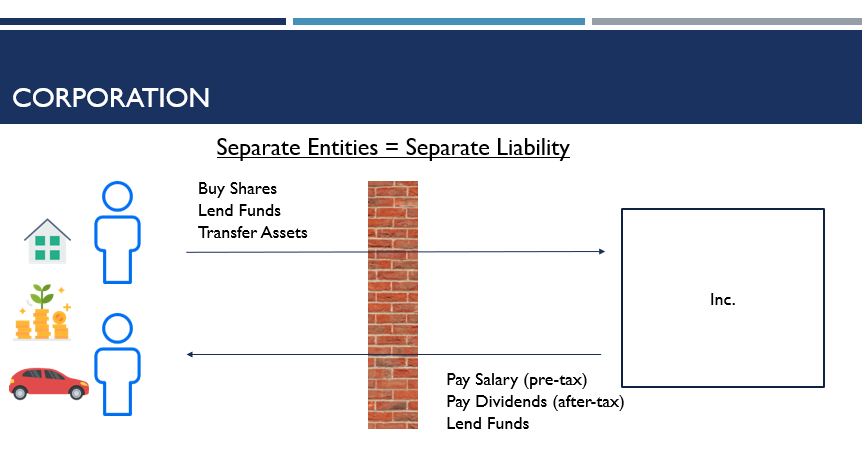

A corporation is considered to be a separate legal entity with its own constitution (Articles of Incorporation), investors/owners (Shareholders), oversight mechanism (Board of Directors) and management (Officers).

It can be formed and operated independently of owners. It can be sold and can be sued as a completely separate legal entity.

Because of that, the corporate legal structure has several advantages and disadvantages that will be discussed further in this article.

These quick illustrations demonstrate how business liability is divided between the owner and the business entity.

Important note: Regardless of the business structure you choose to operate, if your revenues in the last four (4) quarters exceeded $30,000, you are required to start collecting and remitting federal sales taxes (GST/HST).

In addition, if you operate out of non-HST provinces (BC, MB, SK, QC), you will be required to collect provincial sales taxes (PST/RST/QST) on your sales delivered to customers in those provinces.

For a more detailed discussion of how income and sales taxes work for e-commerce businesses, please visit our detailed tax guide for online sellers.

Do I need a corporation to start selling on Amazon / Shopify / other E-commerce platforms?

No. You don’t need to have a corporation to start selling on e-commerce platforms. You can start selling as a sole proprietorship or a partnership. Later on, you can incorporate your business and continue doing business as a corporation.

You are also not required to have a corporation for amazon.com registration.

However, we strongly recommend evaluating pros and cons of incorporating your e-commerce business.

What are the different types of corporations available to Amazon, Shopify, or E-commerce Sellers in Canada?

In Canada, you can incorporate your business provincially or federally. From the taxation standpoint, there is absolutely no difference. The main difference between the two types of corporations pertains to name protection of your e-commerce business.

Under federal corporation, the business name is protected federally. You may register your corporation with every province and operate under your chosen legal name.

With a provincial corporation, your name is protected in that province only. You may face challenges registering that particular legal name in another province if it was already taken.

Also, there are annual filing requirements for federal and provincial corporations. You will need to submit an annual certification online confirming current addresses of directors and that you are not offering company shares to the public.

For federal corporations, you can file an annual return online and it will cost your $20 CAD. For provincial corporations, the form will be filed with your corporate tax return by your accountant at tax time.

Should I open an LLC or a C-Corp Corporation in the United States?

You can open an LLC or a C-Corp in the United States for your e-commerce business. However, if you plan to operate out of Canada that corporation can be declared a resident of Canada for Canadian tax purposes. Meaning that you will have to file corporate income taxes in both Canada and the United States.

IRS requirements for non-resident owned U.S. entities are very complex and are constantly changing. Once you open a U.S. LLC or a corporation, you will subject to multiple reporting requirements from day one.

If you plan operating out of Canada and decide to open a corporation, we strongly recommend opening a Canadian corporation to reduce your compliance costs.

What if I want to open a U.S.-domiciled checking account for my business?

While most U.S. banks will require a U.S. address or a U.S. entity to open a business bank account, it is still possible to open a U.S.-domiciled bank account without having one.

For example, you can use such virtual banks as OFX, Payoneer or Transferwise to collect payments from Amazon and pay your foreign suppliers in USD. Those accounts act exactly as if they are an actual branch.

You can also open cross-border USD accounts with BMO, RBC or TD on your Canadian corporation. To move the money you can use international wire transfers or checks (if the holding period is not too long at your Canadian branch).

What are the advantages of opening a corporation for Amazon, Shopify, or E-commerce Sellers?

Significant Tax Deferral Opportunities

Canada has one of the lowest small business tax rates in the world. Depending on the province your combined small business tax rate will be ranging from 13-15% on the first $500,000. If you don’t plan taking out all profits out of the corporation for personal living expenses, you will save significant amounts on your tax bill.

The small business deduction is only available to businesses generating active business income. An active e-commerce business is considered to be generating this type of income.

Limited General Liability

If your e-commerce business is selling products that can potentially result in a lawsuit, you should consider incorporating it. By operating a corporation you segregate your personal assets from business assets. The corporate structure will be serving as a legal wall between you and your business.

Note that a corporation does not always protect you from financial liabilities. Most lenders, landlords, and suppliers are aware of issues related to separate legal ownership and will require a personal guarantee on any obligations you might take.

Tax Planning

There are several tax planning opportunities available when you own an active business corporation.

Firstly, you can decide if you want to compensate yourself with a salary or dividends. By taking dividends you are automatically saving on Canada Pension Plan contributions that you would otherwise pay if you would have taken a salary.

Secondly, for e-commerce businesses, you can split dividends with passive shareholders older than 25 years, who own more than 10% of any share class. That will significantly reduce your tax bill.

Finally, you can sell shares of your corporation and avoid any capital gains tax on the first $800K (amount changing every year).

Business Optics

You are seen as a more serious business owner if you run your business under a corporation. It is also easier to attract capital and investment if you run your business as a corporation.

Finally, some digital marketers mentioned to me that Google puts a higher ranking factor on businesses that are incorporated.

What are the disadvantages of opening a corporation for Amazon, Shopify, E-commerce sellers?

Requires separate bank accounts

A corporation is considered to be a separate legal entity. As such it requires a separate set of bank accounts and a separate set of books.

Money Belongs to the Corporation

As a separate legal entity, the money earned by the corporation belongs to the corporation until it is distributed in the form of salary or dividends. The business owners must be carefully tracking all amounts taken out or invested into the corporation to avoid landing in the hot waters with the CRA.

Proper Documentation is Required

All major corporate events like changes in directors and management, issuance of dividends and bonuses reorganizations, must be recorded in the Corporate Minute Book. The minute book can be requested by CRA auditors or other external parties to establish validity of business transactions.

Accounting and Tax Costs are Higher

In addition to recordkeeping requirements, a corporation will need to file separate tax returns with the CRA. In order to file corporate tax returns, an accountant will need to have prepared financial statements of the corporation.

Depending on the accountant and the amount of work involved, complete year-end tax work for a corporation will cost in the range of $1,500 – 2,500 CAD (you can read this article if you are wondering about how accountants charge for small business related work).

Losses are locked in the Corporation

Your e-commerce business may incur non-capital losses in the first few years. If you run a corporation, those loses will be trapped in the corporation and can be carried forward for up to 20 years. Whereas with sole proprietorship and partnership business structures those losses can be deducted against other sources of income (e.g. employment income).

Certain Liabilities are Unlimited

The corporate business structure would not protect you if you have put personal property guarantees for your leases, loans or inventory. In addition, directors of the corporation may be personally held liable for any income, payroll or sales taxes owed to the government of Canada.

The concept of non-separability of owner and manager in certain circumstances has been called by lawyers as “piercing the corporate veil”. If your business sells and operates in highly risky business environments (e.g. food, health products, children products), we strongly recommend engaging a competent lawyer to draft proper agreements and legal protections to be put in place.

What are the other considerations when opening a corporation for Amazon, Shopify, or E-commerce Sellers?

Canadian Residency Requirements

Most provincial and federal governments require at least one (1) Canadian resident registered as a director on corporate records. A Canadian resident is defined as someone who holds a Canadian permanent resident card or a Canadian citizenship.

There are only two (2) provinces that area allowing incorporating with no Canadian residency requirements for directors – British Columbia (BC) and New Brunswick (NB).

If you want to incorporate in those provinces, you will need a mailing address located in those jurisdictions. There are multiple companies who can offer those mailing addresses for an annual fee.

Registered Address of Directors

The address of directors is public information. Note that in case of a lawsuit (which is a common business practice in the United States, for example), the notice will be served to that address. If accepted, that notice will signify an acceptance of lawsuit and may result in negative consequences in the future.

For the initial stages of your business, we strongly recommend using mailing address services to protect your privacy and limit the possibility of lawsuits.

What is the ultimate recommendation for Amazon, Shopify, or E-commerce sellers?

If you are just testing the waters, don’t have a lot of assets to protect, and are using all business income for personal expenses, then you might not need a corporation at the moment. The costs of compliance and maintenance of a corporation will outweigh the benefits.

Similarly, if you have partners (like friends or family) who have full-time jobs and who don’t have too many assets to risk, then the partnership business structure may be right for you.

However, if you generate more income than you need for personal expenses, have personal assets to protect and are building a long-term business, then we strongly recommend you opening a corporation for your e-commerce business. The benefits of running your business under this legal structure will outweigh the costs.

What services and pricing do you offer for Amazon, Shopify, or E-commerce sellers?

You can explore our services on this page.

With regards to pricing, we are offering pre-packaged accounting services for every stage of an e-commerce business. You can find our current price ranges here.

For more information, contact us here.