Table of Contents

Introduction

Canadian eCommerce businesses sell across the world. One of the biggest markets for Canadian companies to sell to is, of course, the United States. We share the longest unprotected border in the world, same language, and same economic systems.

Our markets cycle in sync, and both economies are part of the elite G7 club for the world’s most developed economies.

It is not a surprise that the number one target market for the Canadian eCommerce companies is the USA.

But despite all the similarities, Canadian businesses face a lot of uncertainty and unpredictable change from the southern border.

In the recent years, in tune with all the trade wars and the aggressive tone of the new administration the US federal and state government became aware of the fact that a lot of companies unfairly benefit from the vast US consumer market.

Foreign, out-of-country companies sourcing their revenues from the United States have become one of the targets for local governments to fill up treasury coffers.

We have also seen tectonic shifts in the U.S. sales tax legislation across most of the states.

This guide intends to clarify most of the confusion with regards to the US sales tax as it applies to foreign out-of-country eCommerce companies. I will try to break-down important concepts with the help of question and answer method to avoid overwhelming you.

Let’s get started.

Understanding the US Sales Tax System for eCommerce Sellers

What is sales tax?

Sales tax is an additional monetary amount that is added on top of the purchase price by the seller of the goods. Sales taxes are collected by businesses or marketplaces on behalf of various tax jurisdiction. The other names frequently used for sales tax are – Excise Tax (ET), Retail Sales Tax (RST), Sales and Use Tax (SUT), Sales and Local Tax (SALT).

How is sales tax different from income tax?

Sales tax is the amount you collect and remit to the government. It is the money you hold in trust. It does not legally belong to you and is not an expense to your company. You collect the amount, hold it for a specified period of time, and send it to the authorities.

On the other hand, income tax is the amount that you pay as a percentage of your gross or net income. It is an expense to your business that reduces the net worth of the company.

How does the sales tax work in the US?

The United States does not administer a sales tax at the federal level. The sales tax administration falls under the jurisdiction of individual states. So, in the most extreme scenario, your eCommerce business is obligated to deal with every jurisdiction that imposes their own sales tax laws.

How is the US sales tax system different from Canadian?

In Canada, businesses are obligated to register and collect Goods and Service Tax (GST), Provincial Sales Tax (PST), or Harmonized Sales Tax (HST) if they are selling over $30,000 CAD in the last four quarters (more on Canadian sales taxes in this guide).

GST is charged on the federal level regardless of where the consumer is located in Canada. In contrast, the US does not impose sales taxes on the federal level.

Canada has five provinces (ON, NB, NL, PEI, NS) that have consolidated both federal and provincial taxes into one tax rate (HST).

In addition, four provinces (BC, MB, QC, SK) charge their own PST on top of federal GST.

The rest of the provinces and territories (AB, YK, NW, NT) only charge GST.

Most recently the province of Quebec has recently enacted legislation that mirrors economic nexus laws for out-of-province/country eCommerce sellers (more on that in this blog post – Quebec Sales Tax for eCommerce Sellers).

Canadian companies are also obligated to charge sales tax on B2B transactions. To avoid multiple taxation companies can claim input tax credits for sales taxes spent on business-related expenditures.

In the US, to avoid double taxation states only obligate to charge sales taxes on B2C transactions. B2B transactions are mostly exempt by companies obtaining a resale certificate (issued by local tax authorities).

Another major difference is the number of sales tax jurisdictions in the US. In Canada, only the federal and provincial governments have constitutional powers to impose sales taxes. So, at most, you might be dealing with 1 GST/HST (because these two are consolidated) and 4 provincial sales tax accounts.

On the other hand, the US states are composed of counties, independent school districts, and municipalities that all have legal powers to impose their own local sales tax on top of state sales tax rates (hence, you might frequently hear the acronym SALT – State and Local Taxes). According to the most recent data, the US has close to 10,000 sales tax jurisdictions.

Number of Sales Tax Jurisdictions in the US

What are the most recent changes we have seen in the US?

The biggest change we have seen is the extension of the concept of sales tax nexus. In the landmark decision by the Supreme Court in the South Dakota vs. Wayfair on June 21, 2018, the judges agreed that a sales tax nexus can be created simply by conducting a certain level of economic activity in the state. Following this ruling, the concept of the economic nexus was born.

How is economic nexus different from the sales tax nexus?

Economic nexus will be based strictly on the volume of sales and/or unit count you sell into the state. There is no ambiguity in the application of the law. From the states’ perspectives, once you cross that threshold, you are obligated to register and comply.

Physical nexus is created by your company if you have any physical connection to the state. That may include any of the following:

- Having an office in the state

- Having employees in the state

- Storing your goods in a warehouse located in the state (e.g. Amazon FBA or 3PL vendor)

What states have adopted the economic sales tax nexus?

At this stage, most states have adopted the concept of economic nexus. These states have enacted or are in the process of enacting new sales tax registration requirements for out-of-state sellers.

What states do not have sales tax requirements?

There are five states in the US that don’t have sales tax. If you sell to customers in Alaska, Delaware, New Hampshire, Oregon, and Montana, then you are not required to register and collect sales taxes in those states.

In other words, if you have an economic or physical nexus in any of those five states, you are not required to register and collect sales taxes on sales to customers in those states.

The other 45 states do have sales tax collection requirements.

States that do have sales tax requirements

States that do not have sales tax requirements

Are there any goods that are exempt from sales tax requirements?

In general, most tangible goods delivered to an end consumer will be subject to the sales tax. There are specific exemptions available to certain categories.

The exemptions will depend on the state. Most states exempt food, medical supply, B2B sales (resale certificates required). Some states exempt certain professional services. You would need to refer to each state’s legislation for exact details.

Are Canadian companies protected from sales tax laws by US – Canada Tax Treaty?

No. The tax treaty prevents the taxation of net income by one of the states if a company does not have a permanent establishment in one of the countries. First of all, the treaty was signed on the federal level, so it does not apply to any state-level tax regulations. Second, the regulation does not apply to sales tax obligations.

The economic nexus laws were by design enacted to obligate out-of-state companies to fall under their sales tax jurisdiction by virtue of economic activity. At the moment, none of the tax treaties will exempt a Canadian company from US sales tax obligations.

Does Public Law 86-272 protect Canadian eCommerce Companies?

This law was enacted in 1959 to prevent states imposing their income taxes on out-of-state companies simply because they are soliciting orders to customers in those states. It was designed to protect US companies from paying multiple state income taxes just because they are selling to customers in different states.

As it goes with the US tax system, there are a lot more intricacies to the application of the law, but for the purposes of this article, we have to note two important aspects:

- It does not apply to sales tax regulations

- It does not apply to out-of-country companies doing business in the US

Registering and Remitting US Sales Tax for eCommerce Sellers

I operate and sell as a sole proprietor (not a corporation) in the US. Do these rules apply to me?

Yes. Although sole proprietorship/partnerships are not considered to be distinct legal entities separate from its owners, they are still considered to be a business from the sales tax point of view (see advantages vs. disadvantages for operating a sole proprietorship for eCommerce sellers in this post).

How will state authorities know that I am selling to the customers in that state?

State authorities have the legal power to source the company and sales-related information from various sources. This includes, but is not limited to:

- Platforms you are selling on (Amazon, Shopify, Overstock)

- Large banks (Chase, Bank of America, Wells Fargo)

- Vendors and suppliers you are using in the US

With advancements in technology and digitization of accounting records, counterparties may provide required information to governments for a large number of eCommerce sellers in a matter of days. So the identification part is not as cumbersome and resource-consuming as it used to be.

What powers do individual states have?

A state department of revenue has virtually unlimited power to bring your eCommerce operations in the US to a complete halt. If the state authorities believe that your company should have registered and collected sales taxes, they have the power to impose an arbitrary notional assessment on your business.

In other words, they will determine what you owe based on what they think you owe. After a notional assessment has been posted on your account, you will be deemed to owe taxes to the state, and the state will start their attempts to collect those amounts. The attempts may include freezing your bank/PayPal accounts, suspension of EIN, suspension of brokerage, and marketplace accounts.

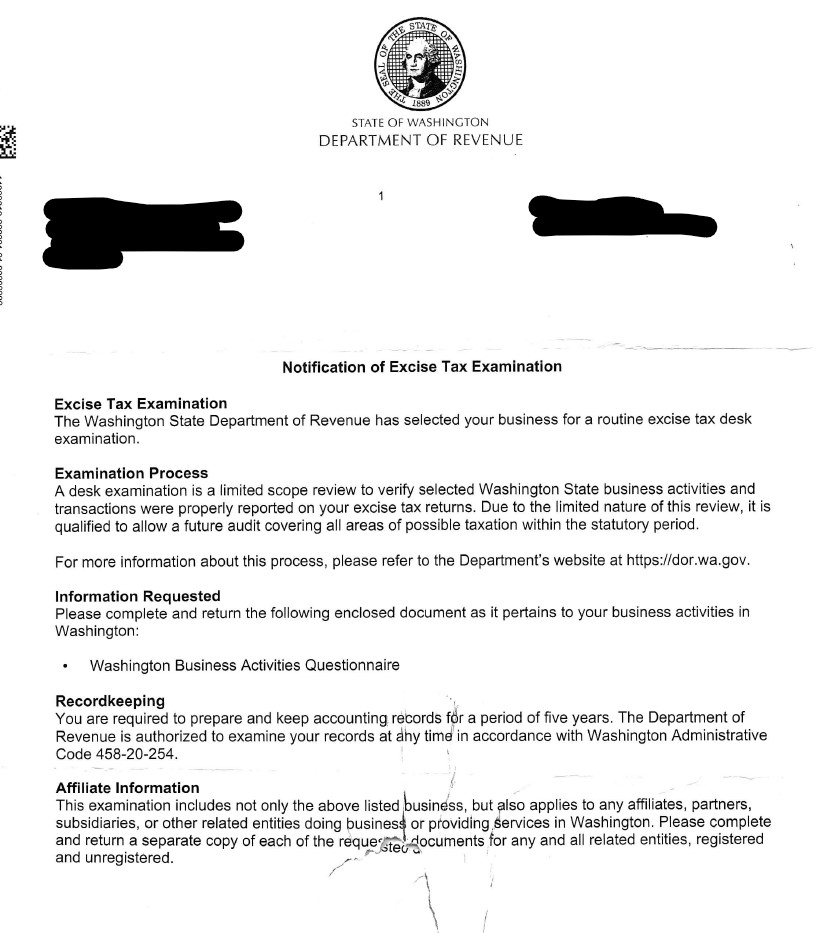

I received a letter from the state of [put the state name here]. Should I comply?

You might have received a letter that may look like the example shown below or in a similar format. That means that the state department of revenue has sourced your company information and are looking for additional information provided by you. Don’t panic, most of the times they are trying to see if your eCommerce company should be registering for a sales tax account.

My recommendation is 1) speak to a professional of your choice 2) ultimately provide the requested information. Yes, you may be subject to prior period interest and penalties, but at the end of the day, you don’t want to risk losing the privilege of doing business in the US for your company.

If you cooperate, some states will require you to register prospectively, which means that you won’t be held liable for uncollected sales taxes from the prior period.

What about dropshipping by US suppliers?

What about dropshipping by US suppliers?

If you are dropshipping goods by using a US supplier, then you are the end retailer of goods. It means that your company will be subject to the economic nexus regulations described above. To complicate the situation, most US suppliers will require from you a resale certificate.

A resale certification essentially exempts sales taxes on B2B transactions. The certificate will need to be obtained from the state authorities. By issuing a resale certificate, the state will also issue your company a registration number that will obligate your company to collect, file, and remit sales tax returns in that state.

How will I know when to register?

The best way to know your company’s sales tax obligations is to constantly analyze your exposure based on current requirements in each state. You need to understand how much revenue and the unit count sold in each state. You also need to know if have created any physical nexus to any of the states by holding your inventory in that state.

I am just starting out and don’t have too many sales. Am I still obligated to register?

Some states have economic nexus threshold based on the unit count you sold to each state. For example, you will trigger the economic nexus requirement in the state of Illinois if you sell more than 200 units to customers in that state in a rolling 12-month period.

In short, you may meet certain states thresholds even though your revenues are still low.

We are a big organization with $10M+ in sales, what are our options?

If you are a bigger organization with sales of $10M+ in the US, you might want to hire a consulting firm that will perform a complete sales tax nexus study based on the products you are selling. The cost of this study is usually between $10K-20K USD. This study will determine the exposure for each product and each state at a specified point in time.

The study will usually need to be repeated every 2-3 years because the laws are frequently changing.

What is the statutory limitation period for uncollected sales taxes?

Statutory limitation period means that if there are no blatant gross negligence and fraudulent violations of tax laws by the company, the states can only re-assess your tax return up to a certain number of year back. Most states have a statutory limitation period of 3-5 years.

How can I register for each states sales tax permit?

Most states have created online portals that will allow to register and obtain a registration number. You can file and pay your sales tax amounts online.

What are the reporting periods and due dates?

Most states will have either monthly, quarterly, or annual filing frequencies, depending on the volumes you are selling into the state. The due date to send the amounts will be usually 30 days after the reporting period end.

Similar to Canada, there will be significant interest & penalties that will apply for any amounts owed after those due dates since you are holding the government’s money in trust.

What if I meet the economic nexus in one year and then my sales drop?

Once you register, you are still obligated to collect and file returns. In case, you have had zero sales into that particular state, you will need to file a nil remittance return by the due date.

Am in trouble if I start collecting sales taxes without a registration?

It is illegal to collect sales tax from customers if you haven’t obtained a sales tax permit/registration number from the state. Please make sure that you register first before you start collecting.

If I register, do I have do remit and pay state income taxes as well?

It depends on the volume of sales. Some states will impose their version of income taxes (e.g. franchise tax in California, Business & Occupation Tax in Washington) if you sell over a certain threshold. In other words, if you meet the economic nexus requirements for sales tax, your company may also be obligated to file and pay state income taxes.

If you file and pay state income taxes, your company will be able to claim the foreign tax paid as a foreign tax credit on the Canadian tax returns. The CRA realizes that companies face a variety of business taxes by doing business abroad. The unused foreign tax credits can be carried back 3 years and carried forward 10 years to reduce your Canadian business income tax obligations.

How do I deal with almost 10,000 sales tax authorities in the US?

Local tax collection is administered by state departments of revenue. In other words, you are still dealing with potentially 45 individual states to collect and remit your sales taxes.

However, it will be your responsibility to collect the right amount of tax depending on the destination address of your goods. Bigger marketplaces and selling platforms will allow you to enable sales tax collection by state. They will have the up-to-date rates for each ZIP code and collect the right amount on your behalf.

How do I setup sales tax collection on my Amazon and Shopify stores?

Here is the guide on how to setup sales tax collection on your Amazon store. You must have a Professional Selling plan and the registration number from state authorities.

Here is the guide on how to setup sales tax collection on your Shopify store. You must have a registration number before you can start collecting the amounts.

Understanding Marketplace US Sales Tax for eCommerce Sellers

In addition to adopting economic nexus legislation, most states have also enacted marketplace sales tax laws. These laws require a marketplace facilitator like Amazon, Etsy, eBay, etc. to register, collect, and remit sales taxes on eCommerce sellers behalf.

What is the difference between a platform and a marketplace?

Each state will have its own definition of a marketplace, but in general, a marketplace will connect buyers and sellers, administer pricing, collect a commission, and have greater control over the process. Amazon, Etsy, eBay, and other providers are good examples of marketplaces.

A platform will have a lesser degree of control over your business. You will have the ability to set your own pricing, deal with your customers directly, and have greater flexibility in managing your inventory. Good examples of platform services would be Shopify, Magento, and WooCommerce-powered websites.

Should I register and report sales taxes if I strictly operate my business from a marketplace?

It will depend on state requirements. If you strictly sell on a marketplace that is already registered and is collecting sales taxes on your behalf in the state where you have an economic nexus, then you might not need to go through the separate registration process.

However, in case of an audit, you will need to be able to demonstrate that the marketplace has been collecting and remitting sales taxes on your behalf.

Should I register if I sell from a marketplace AND a platform?

Most economic nexus thresholds are based on the total gross income and/or unit count you sell to state’s consumers in aggregate. For example, if you sell on Amazon to Colorado customers $90,000 USD and on Shopify $10,000 USD, then you will meet the economic nexus threshold of $100,000 in that state.

Amazon will collect and remit sales taxes on $90,000, and you will need to register and start collecting Colorado sales tax on your Shopify sales.

Accounting for US Sales Tax for Canadian eCommerce Sellers

What accounting apps are available to me?

Cloud accounting software like Quickbooks Online and Xero will be able to track the sales tax amounts for each state. The setup may be complex depending on the number of platforms and registered states.

What sales tax tracking tools are available to me?

There are a few apps on the market that help track, pay & remit US sales taxes. They usually charge based on the order volume, the number of state registrations, and filing frequencies. The integration with cloud accounting systems may be quite complex as well. The biggest tools on the market are TaxJar and Avalara.

What is your recommendation on registering with each state?

My recommendation is to take a risk-based approach. You will need to weigh costs of compliance vs. non-compliance. At the very least, I recommend you to know your obligations in each state you are selling to. Since costs of compliance can become very high, you might decide not to register in every single state where you have economic nexus.

Know your exposure to uncollected sales tax + penalties & interest for each state. Once the risk becomes material, you might want to register for the sales tax account and fulfill your obligations.

If you are selling over $1M into the US, I do recommend registering in the states where you are sourcing 80% of your revenue from. This way you will be protecting your sources of revenue and ensure uninterrupted sales for your company.

References

https://www.avalara.com/us/en/learn/sales-tax/south-dakota-wayfair.html

https://en.wikipedia.org/wiki/Sales_taxes_in_the_United_States